How to Find IFSC Code Online & Offline of Your Bank Branch

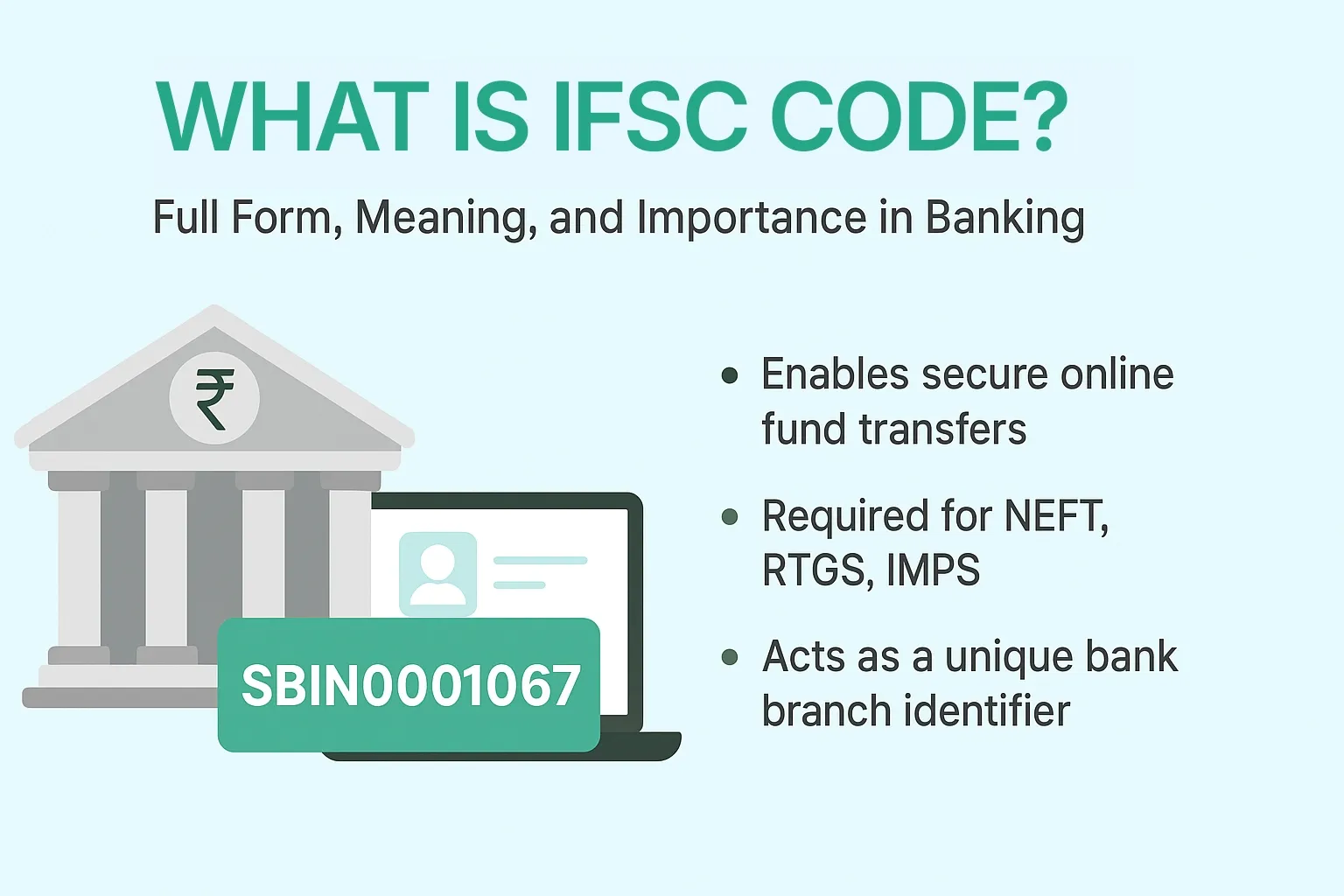

What is an IFSC Code?

The IFSC code (Indian Financial System Code) is a unique 11-digit alphanumeric code assigned by the Reserve Bank of India (RBI) to every bank branch in India. It's a crucial identifier for electronic fund transfers like NEFT (National Electronic Funds Transfer), RTGS (Real-Time Gross Settlement), and IMPS (Immediate Payment Service). The code is made up of three parts:

- The first four characters represent the bank name.

- The fifth character is always a zero (0), reserved for future use.

- The last six characters represent the specific bank branch.

For instance, in the code HDFC0000001, 'HDFC' signifies the bank, '0' is the control character, and '000001' identifies the specific branch.

Why is the IFSC Code so Important?

Think of the IFSC code as the postal code for your bank branch. Just as a postal code ensures a letter reaches the correct address, the IFSC code guarantees that your money is transferred to the right bank and branch. Without it, electronic transactions wouldn't be possible. It helps in:

- Quick and accurate fund transfers

- Preventing transaction failures

- Ensuring security and traceability of funds

In today's digital world, where most financial transactions are electronic, knowing your bank's IFSC code is a fundamental requirement.

How to Find IFSC Code: The Easiest Methods

Finding your IFSC code is simpler than you might think. There are several ways to do it, both online and offline.

1. Find IFSC Code Online: The Digital Way 💻

The internet offers a plethora of options to check your IFSC code instantly.

a. Your Bank's Official Website or App

This is often the most reliable method. Most banks have a dedicated "Branch Locator" or "Find IFSC Code" tool on their website. You simply need to select your state, city, and branch name, and the site will display the code. Similarly, many bank apps have this feature built-in.

b. Third-Party Financial Websites

Numerous financial portals and websites like BankBazaar, Paisabazaar, and others provide extensive databases of IFSC codes. A quick search on Google for "IFSC code finder" will lead you to several such sites. Just enter your bank's name, state, and city to get the code. Pro tip: Always cross-verify the code from a second source to be safe.

c. Internet Banking Portal

When you log in to your internet banking account, you can usually find your IFSC code in the "My Account" section, often listed alongside your account number.

d. RBI's Official Website

The Reserve Bank of India maintains a complete list of all bank branches and their respective IFSC codes. While this might be a bit more technical, it's the most authoritative source.

2. How to Find IFSC Code Offline: The Traditional Way 📖

If you don't have internet access or prefer traditional methods, these options are for you.

a. Your Bank Passbook

The most common place to find your IFSC code is on the first page of your bank passbook. It's usually printed right next to your account number and branch details.

b. Cheque Book

Look at one of your cheque leaves. The IFSC code is almost always printed on the top left or top right corner of the cheque, sometimes near the cheque number.

c. Bank Statement

If you receive a physical bank statement, your IFSC code will be listed in the header along with your other account details.

d. By Calling Customer Care

You can call your bank's customer care number and ask for your branch's IFSC code. Be prepared to provide your account number and other verification details.

e. Visiting Your Bank Branch

The most straightforward offline method is to simply visit your bank branch and ask a bank official. The IFSC code is often displayed on a notice board or counter as well.

Where is IFSC Code Used?

- Online fund transfers (NEFT, RTGS, IMPS)

- Loan, insurance, and government forms

- Linking accounts for investment platforms (MF, stocks, etc.)

- Salary credits and direct benefit transfers

- Bill payments, e-mandates, and recurring transactions

What to Do If the IFSC Code is Wrong?

Using an incorrect IFSC code can lead to a failed transaction or, in rare cases, a transfer to a wrong account. If a transaction fails, the amount is usually credited back to your account within 24-48 hours. However, it's always best to double-check the IFSC code before initiating any transaction.

How to Ensure Your IFSC Code is Correct

- Always double-check the code on official bank channels (website/app/passbook).

- If your branch has merged or changed (common after a bank merger), check for an updated IFSC.

- Avoid using outdated details from third-party sites—verify on RBI or your bank’s website.

Conclusion

Finding your IFSC code is quick and simple. Whether you choose online methods like bank websites, RBI portal, or mobile banking, or offline ways like passbooks, cheque books, and branch visits, you’ll always have easy access to it.

By knowing how to get IFSC code and where to find it, you ensure smooth, secure, and error-free digital transactions every time.

FAQs (Frequently Asked Questions)

1. Is the IFSC code the same for all branches of a bank?

A: No, the IFSC code is unique to each specific bank branch. While the first four characters representing the bank will be the same, the last six characters are different for every branch.

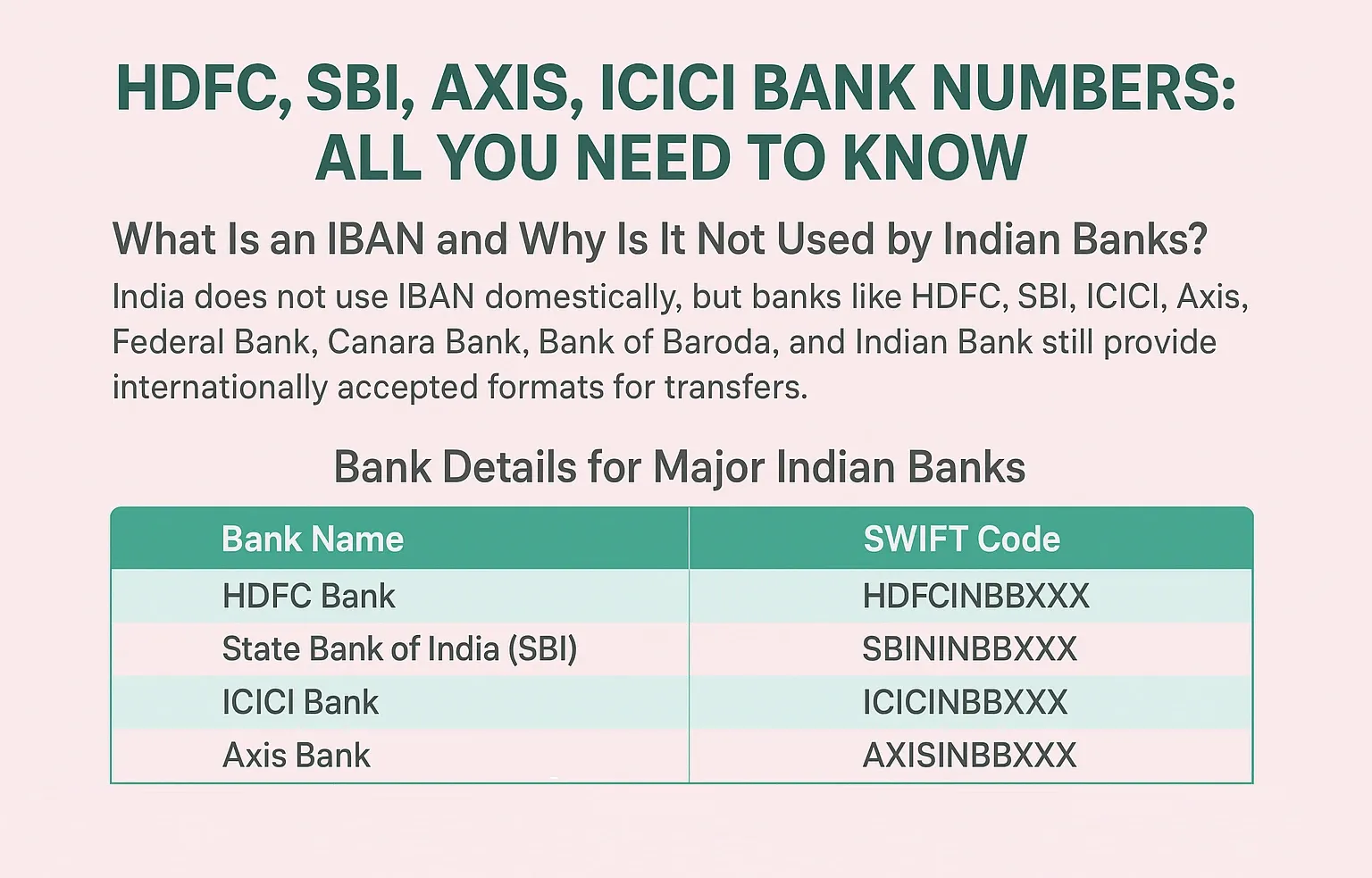

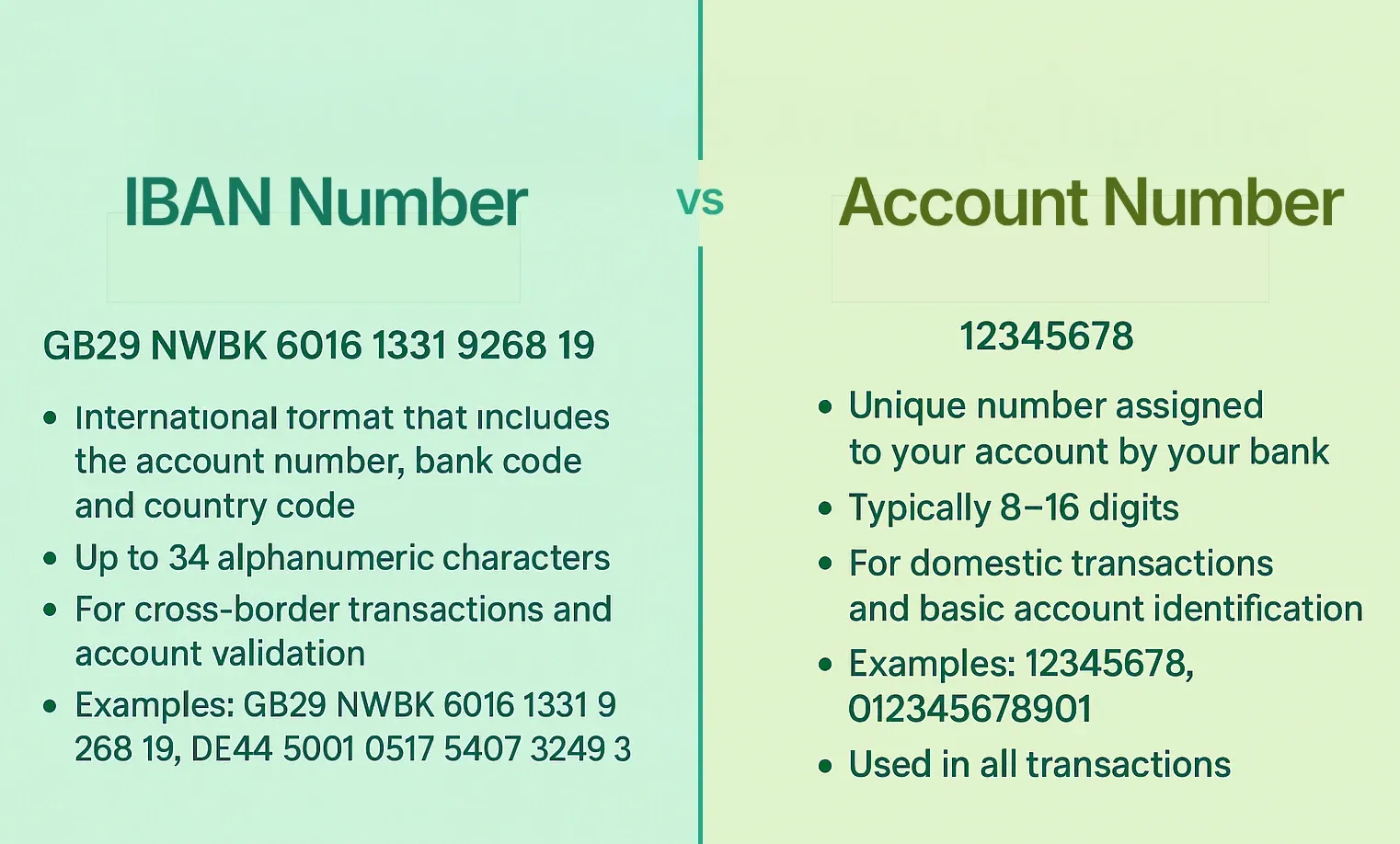

2. Is the IFSC code and SWIFT code the same?

A: No. The IFSC code is used for domestic electronic fund transfers within India. The SWIFT code (Society for Worldwide Interbank Financial Telecommunication) is used for international wire transfers.

3. How can I check if an IFSC code is valid?

A: You can use any of the reliable online IFSC code finders or your bank's official website to verify the code. Enter the code to see if it links to the correct bank and branch.

4. Do I need the IFSC code for cash deposits?

A: No, the IFSC code is not required for a cash deposit at your bank branch. It's only necessary for electronic fund transfers like NEFT, RTGS, and IMPS.

5. Can I get my IFSC code using my account number?

A: Yes, many online tools and bank websites allow you to find the IFSC code by entering your account number and other details. However, it's more common to find it by searching for the bank and branch name.

6. What happens if I use an invalid IFSC code for a transfer?

A: The transaction will most likely fail and the money will be returned to your account. The system will flag the invalid code and stop the transfer.

7. Where is the IFSC code located on the bank statement?

A: On your bank statement, the IFSC code is typically located in the top section, near your name, address, account number, and other branch details.

8. Does every bank branch in India have an IFSC code?

A: Yes, according to RBI regulations, every bank branch participating in electronic fund transfers must have a unique 11-digit IFSC code.

9. Can I transfer money without an IFSC code?

A: For online transfers like NEFT, RTGS, and IMPS, the IFSC code is mandatory. Without it, you cannot initiate the transaction.

10. How do I know if the IFSC code is real or fake?

A: To ensure the authenticity of an IFSC code, always use a trusted source like your bank's official website, a physical document from the bank (passbook, cheque book), or a reputable financial portal.