How to Receive International Payments in India: Complete Guide for Freelancers and Businesses

Working with overseas clients can be highly rewarding—but getting paid across borders can be tricky if you’re not familiar with the process. Whether you’re a freelancer, startup, or established business, receiving international payments in India requires the right banking setup, compliance with regulations, and knowledge of available transfer options.

This guide by EximPe explains the methods, costs, documentation, and best practices to ensure you get your payments securely and on time.

Understanding How International Payments Work in India

International payments involve transferring money from a sender in another country to your Indian bank account. The process typically includes:

- The Sender’s Bank or Platform – Initiates the transfer

- Intermediary Banks – Facilitate cross-border transactions

- Your Bank in India – Receives and credits the payment in INR

In India, the Foreign Exchange Management Act (FEMA) regulates such transfers. All inflows must go through authorized banks and channels.

Best Methods to Receive International Payments in India

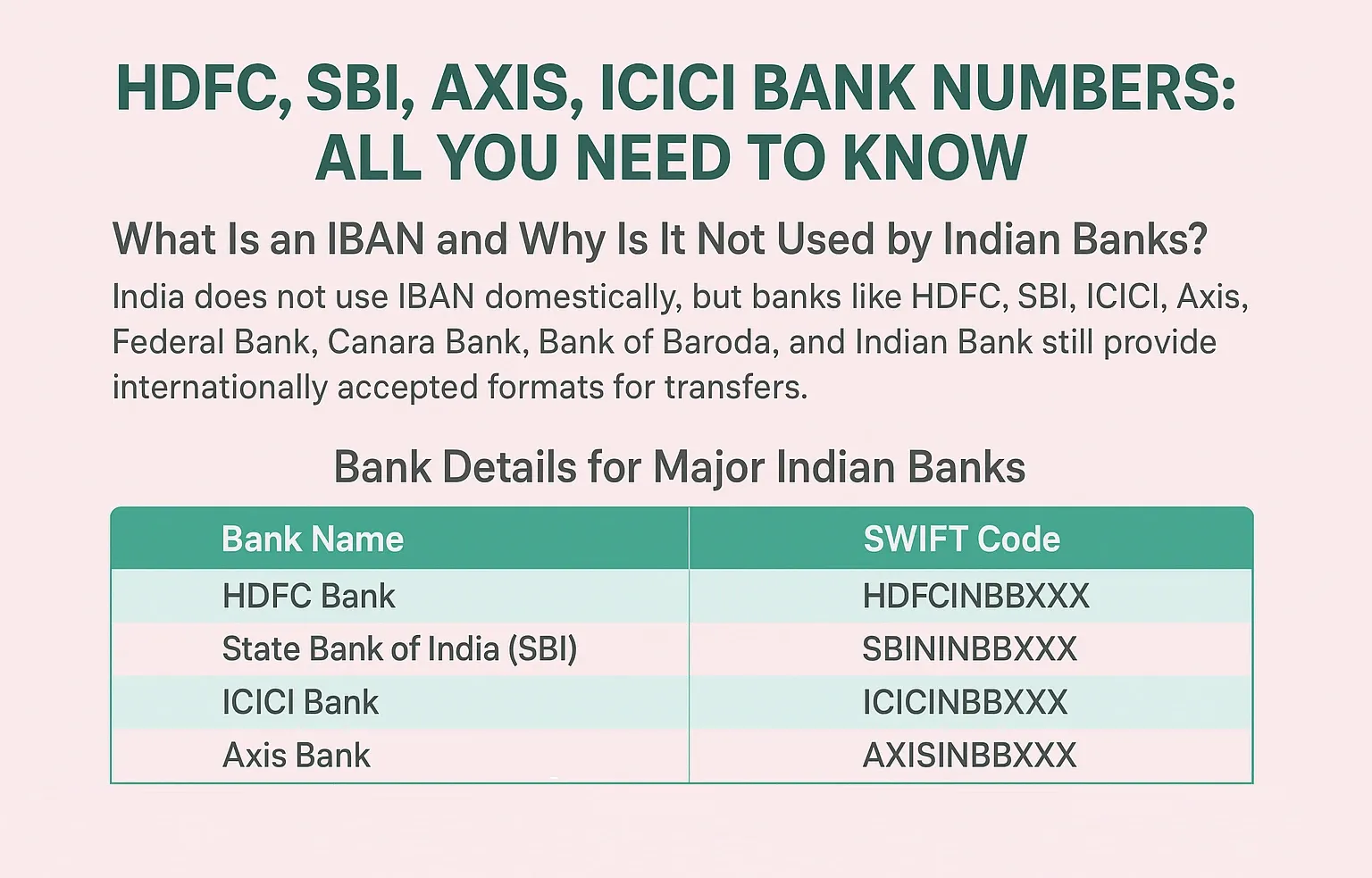

A. Bank Wire Transfers (SWIFT Transfers)

- How it works: Client sends funds from their bank to yours via SWIFT network

- What you need:

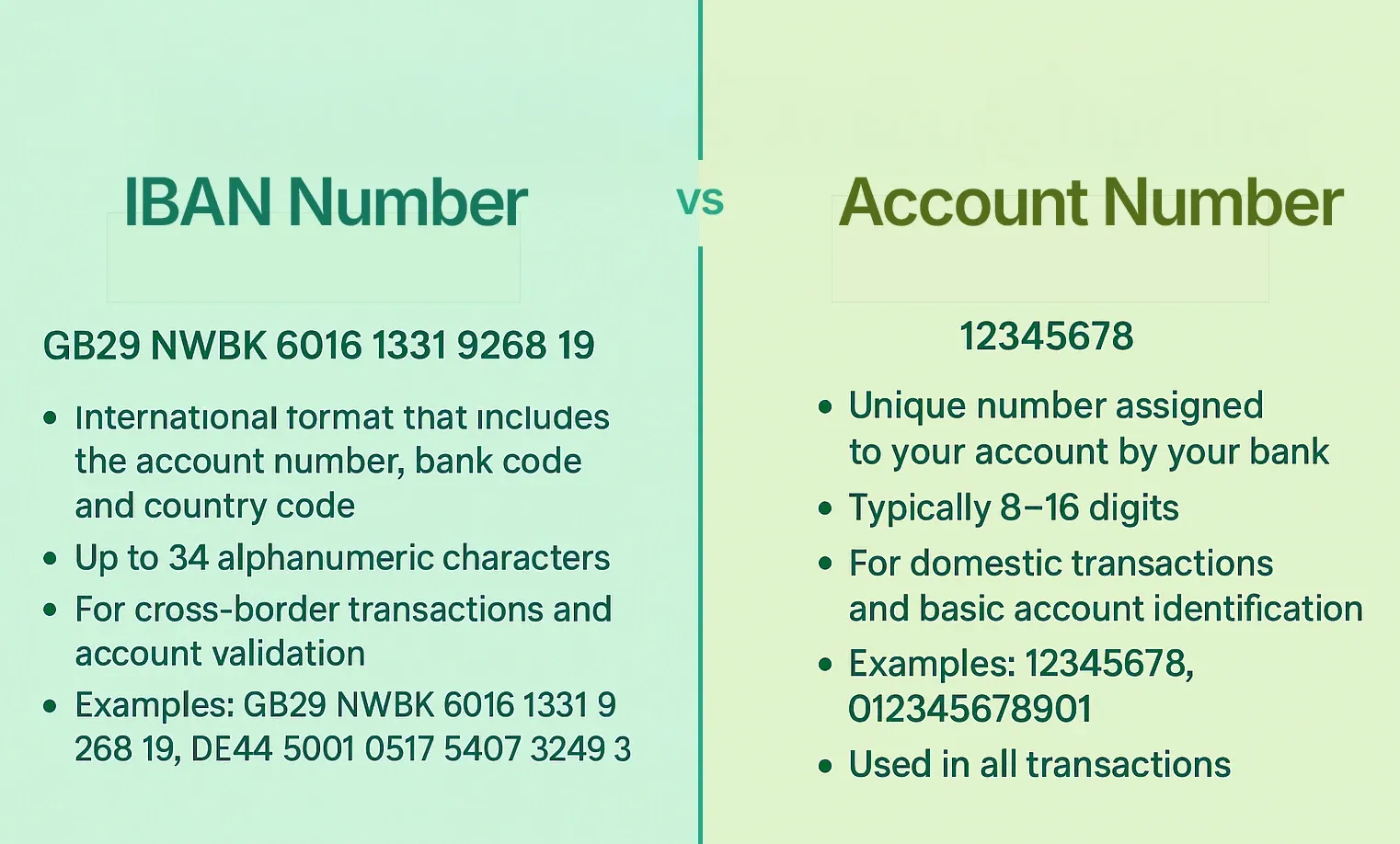

- Bank account number

- SWIFT/BIC code of your bank

- Bank branch address

- Pros: Secure, widely accepted

- Cons: Higher fees, slower (3–7 days)

B. Online Payment Gateways

Online Payment Gateway Platforms like PayPal, Payoneer, Wise (TransferWise) make it easy to receive payments directly online.

PayPal:

- Popular with freelancers

- Instant receipt but higher currency conversion fees

Payoneer:

- Ideal for marketplace payouts (Amazon, Fiverr, Upwork)

- Lower fees than PayPal

Wise:

- Transparent exchange rates

- Direct to your Indian bank account

C. International Cheques/Demand Drafts

- Sent physically by mail

- Extremely slow and not recommended unless unavoidable

D. Foreign Currency Demand Draft (FCDD) through Bank

- Client deposits funds into a correspondent bank abroad

- You collect the demand draft in India

- Lower fees but longer processing time

Documents Required to Receive International Payments

Your bank or payment provider will typically require:

- Invoice or payment request

- PAN card (for tax compliance)

- Proof of service/product delivered

- FIRC (Foreign Inward Remittance Certificate) – issued by the bank after receiving funds

- Purpose code – categorizes the type of payment (e.g., export of services, royalty, etc.)

Fees & Exchange Rates to Watch Out For

- Transfer fees – Charged by the sender’s and recipient’s banks or platforms

- Currency conversion margin – Banks often add a 2–4% markup on exchange rates

- Platform fees – PayPal and others charge per transaction (often around 3–5%)

Pro Tip: Use platforms like Wise or EximPe to get better currency conversion rates and lower fees.

Compliance and Legal Requirements in India

- GST on Export of Services – Usually zero-rated, but you must file returns

- Income Tax – All foreign income is taxable in India

- FEMA Compliance – Payments must be received through authorized channels

Best Practices for Receiving International Payments

- Always send clear invoices with payment terms

- Include bank/SWIFT details in every invoice

- Keep a record of transactions for tax purposes

- Use trusted payment gateways to avoid scams

- Ask for advance or milestone payments for large projects

Comparing Payment Methods for Freelancers and Businesses

Step-by-Step Process to Receive International Payments in India

- Choose Your Preferred Payment Method: Evaluate banks, payment gateways, or virtual accounts based on transaction size, speed, fees, and convenience.

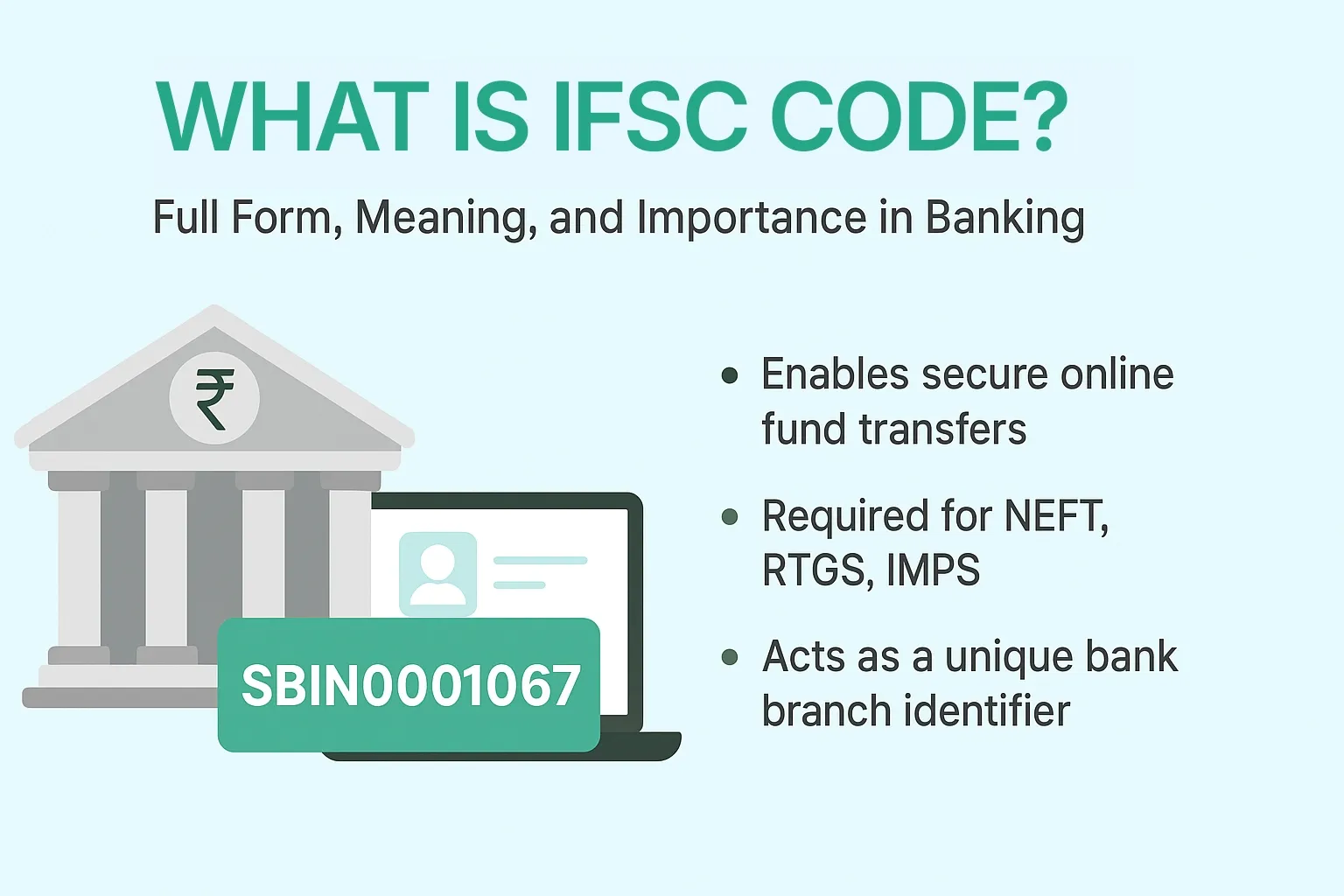

- Provide Accurate Payment Details to Client: Share your IFSC, SWIFT/BIC code, account number (for banks) or invoice link/email (for gateways), or virtual account details.

- Comply with RBI Regulations: Share purpose codes that define the nature of your transaction for RBI compliance (e.g., software export, consulting services).

- Receive the Payment: Funds will be debited from your client’s account and credited to you after processing time.

- Get Foreign Inward Remittance Advice (FIRA): Ensure your bank or service provider issues you FIRA or equivalent documentation for accounting and GST purposes.

- Withdraw or Use Funds: Convert foreign currency to INR if required and withdraw to your linked bank account.

Tips to Save on Fees and Time

- Use virtual accounts or fintech platforms with minimal forex markup and no hidden charges.

- Bundle payments where possible to reduce per-transaction fees.

- Always verify payment details and purpose codes to avoid rejection or delays.

- Request digital FIRCs from service providers to avoid additional bank charges.

- Keep your PAN, KYC, and business documentation updated to speed up compliance.

How EximPe Can Help You Receive International Payments

If you’re an exporter, importer, freelancer, or business receiving payments from abroad, EximPe offers a powerful, fully digital solution to simplify the process.

EximPe is a one-stop platform for exporters and importers, helping with:

- FX Payments – Access live forex rates and lowest margins

- Compliance Solutions – Submit payment documents online, 100% paperless

- Lightning-Fast Transactions – Avoid delays common in traditional banking

- 24/7 Customer Support – Expert assistance whenever you need it

FAQs

1. How can I receive international payments in India online?

You can use EximPe, PayPal, Payoneer, Wise, or direct bank transfers via SWIFT.

2. Is PayPal safe for receiving payments from abroad?

Yes, but it has higher currency conversion and transaction fees compared to other platforms.

3. What is the fastest way to receive money from abroad in India?

EximPe , PayPal, and Payoneer are the fastest; SWIFT is slower but more secure for large sums.

4. Do I need a special account to receive international payments?

No, a regular savings or current account works, but some prefer specialized export-oriented accounts for business transactions.

5. What is a purpose code and why is it needed?

It’s a code assigned by RBI to identify the reason for an inward remittance (e.g., software export, consultancy services).

6. What is an FIRC and how do I get it?

A Foreign Inward Remittance Certificate is proof of money received from abroad. Your bank issues it upon request after the transaction is completed.

7. Are international payments taxable in India?

Yes, all foreign income is taxable under Indian income tax laws.

8. Can I use UPI to receive money from abroad?

Not directly. UPI is domestic, but some platforms are testing cross-border UPI solutions.