Step-by-Step Guide to Sending Money Using a SWIFT Code

In an ever-increasing interconnected world, firms and people must have solid international payment systems. Eximpe is committed to achieving secure, efficient and transparent global payments to both businesses and individuals. That is why we’re outlining waat it takes you to send funds through a SWIFT code; this is your ticket into the global payments world.

What is a SWIFT Code?

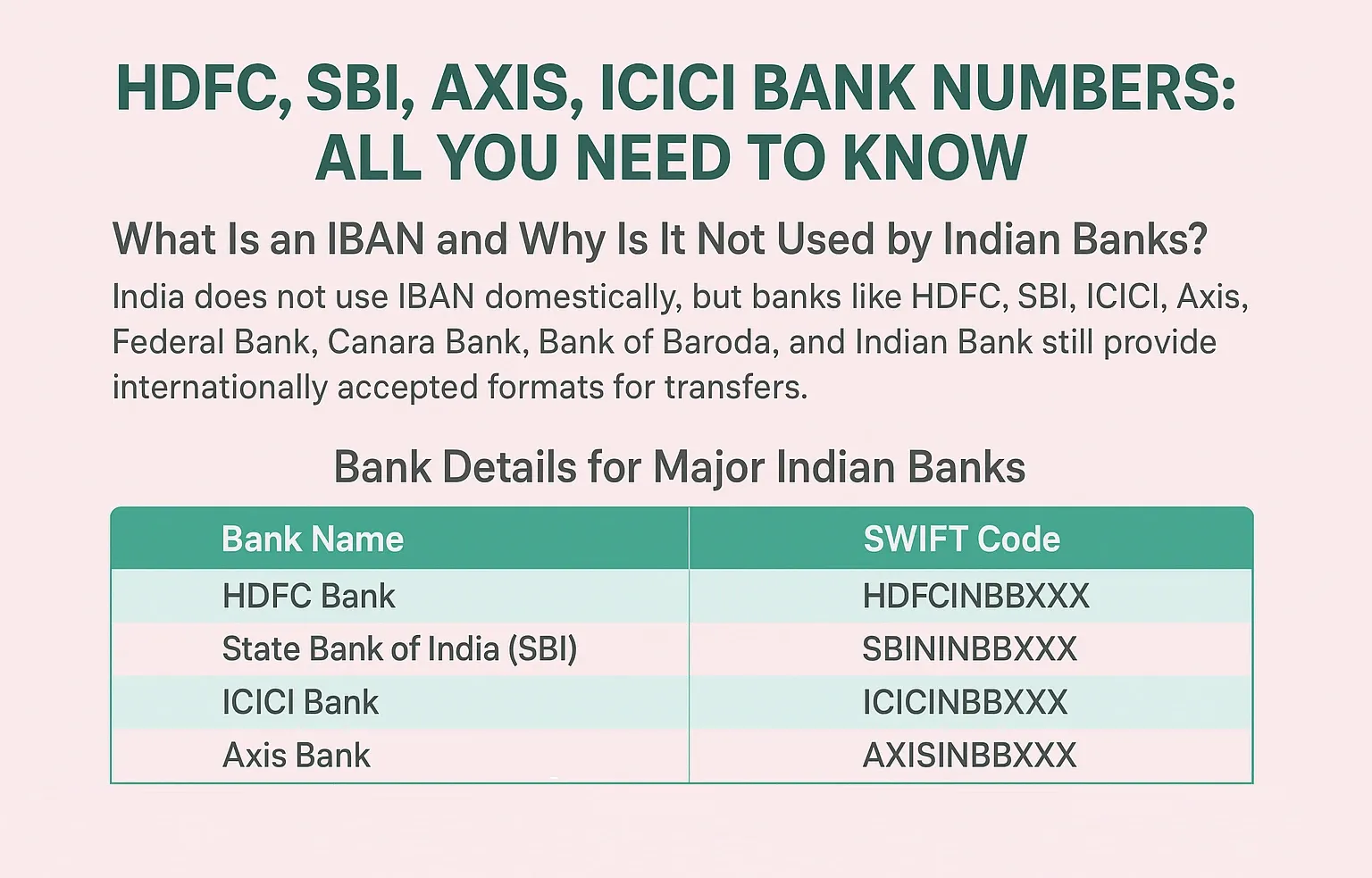

SWIFT Code, or Bank Identifier Code (BIC), is a universal identifier of banks, provided they stand by a uniform alpha-numeric code. It ensures that your money reaches its intended bank account through a SWIFT money transfer, which is essential in any global transaction.

How SWIFT Payment Works

The SWIFT network ensures that banks have a secure conduit where they can transmit payment orders instead of transferring money themselves. At the beginning of a SWIFT transfer, your bank encrypts and transmits a message to the recipient’s bank, including the details of the transaction. The funds are transferred from one bank to the other, using the Nostro and Vostro accounts through the network of correspondent banks so as to arrive at the beneficiary.

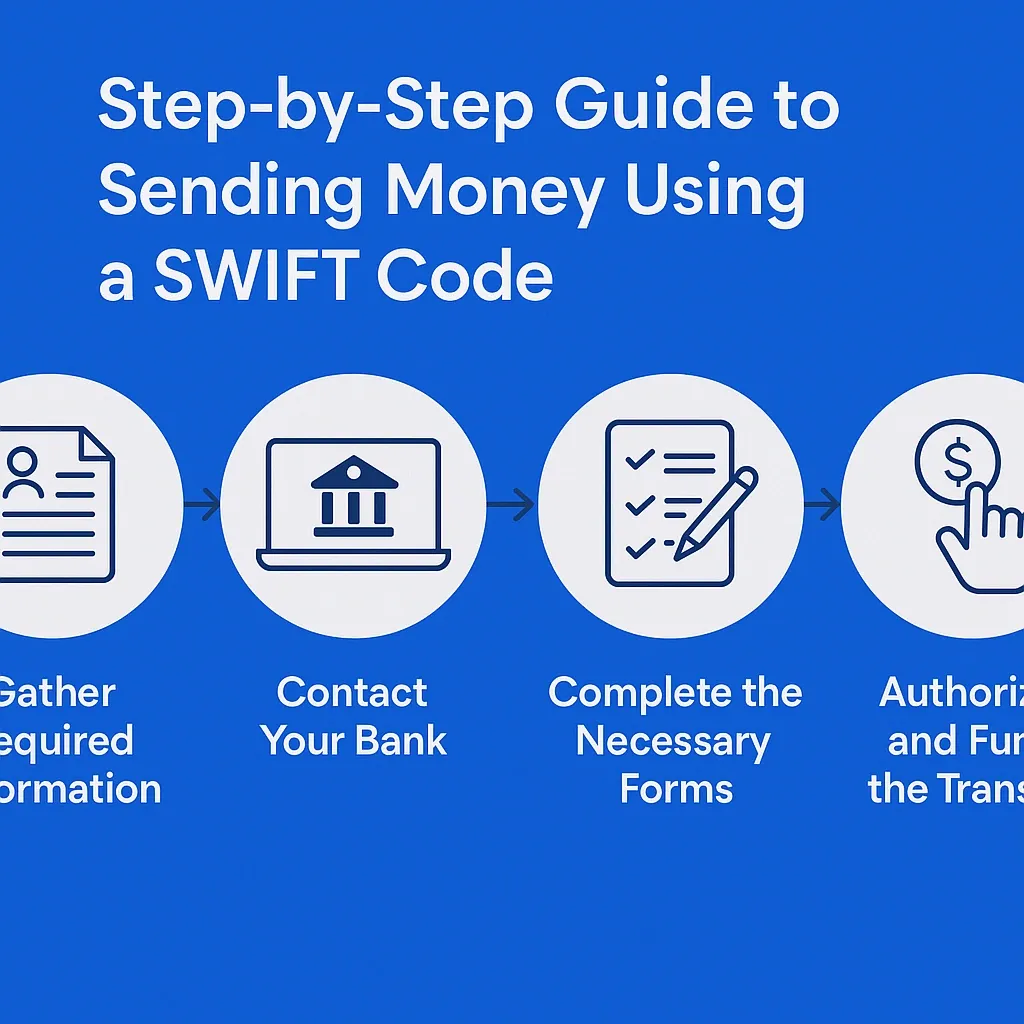

Step-by-Step: Sending Money Using a SWIFT Code

Gather Required Information

- Recipient’s full name and address

- Recipient’s bank name and address

- Recipient’s account number or IBAN The bank’s SWIFT code (BIC)

- The amount and currency for which money is to be sent.

Contact Your Bank or Use EximPe’s Platform

- Visit your bank’s physical presentation, log in with their site or get access to EximPe’s online platform.

- Enter the gathered data so that the transaction via SWIFT can be carried out.

Complete the Necessary Forms

- Fill in the international transfer form, confirming that all details are correct.

- Check the code used when sending your money (the SWIFT code) to rule out any delays or mistakes in routing your funds.

Authorize and Fund the Transfer

- Click to approve and release account payment for the transfer.

- Examine any accompanying fees and prices of exchange rates as intermediary financial institutions may charge SWIFT transfers.

Track and Confirm the Transfer

- After the transfer is initiated, you will be notified with a confirmation and always given a tracking reference.

- Time for SWIFT global payments is not constant, with most transactions taking between 1- 5 business days, depending on the involved banks.

Tips for Smooth SWIFT Transfers

- Accuracy is Key: Any error in the SWIFT code or beneficiary details can delay your SWIFT transfer.

- Understand the Fees: Multiple banks may be involved, each potentially charging a fee for their role in the SWIFT payment process.

- Track Your Payment: Modern SWIFT global payments, especially with SWIFT gpi, offer real-time tracking for greater transparency.

Why Choose Eximpe for SWIFT Transfers?

At Eximpe, we employ the latest technology in the SWIFT global payments, ensuring that all cross-border transactions at EximPe are secure and transparent and conform to all compliance standards. Using EximPe, you are able to enjoy easy money transfers, where the risks of errors are lowest, and you can track every SWIFT deal in real-time.

Conclusion

The use of a SWIFT code when international money transfers is an established means of making secure global payments. With the help of EximPe and this guide, you can smoothly exploit the complexities of international SWIFT payments without the risk that your funds will not arrive to you reliably wherever your business may be.

FAQs

1. What information do I need to send money internationally with EximPe using a SWIFT code?

You’ll need the recipient’s full name and address, their bank’s name and address, account number or IBAN, the bank’s SWIFT code (BIC), and the amount and currency to be sent.

2. How long does a SWIFT transfer take with EximPe?

Most SWIFT payments through EximPe are credited to your recipient’s account within 1–5 business days, with many trade payments processed within 24 hours.

3. What are the fees for sending money via SWIFT on EximPe?

EximPe charges a transparent platform fee (typically 0.75% per transaction) plus a fixed SWIFT transfer fee, with no hidden markup on currency conversion.

4. How do I track my SWIFT payment on EximPe?

You can track your payment in real-time through EximPe’s online dashboard, which provides instant updates and a digital FIRA for compliance.

5. Is EximPe safe and compliant for SWIFT transfers?

Yes, EximPe employs advanced security, complies with RBI and FEMA regulations, and partners with licensed banks, ensuring your international payments are secure and fully compliant.