Understanding the New Income Tax Slabs for FY 2025-26: What You Need to Know

India's income tax system has seen substantial changes as a result of the Union Budget 2025–2026, most notably the "new tax regime." Every taxpayer must understand these changes as we enter the Financial Year 2025–26 (Assessment Year 2026–27) in order to efficiently manage their finances and minimize their tax obligations. This thorough guide will explain the new income tax slab rates, contrast them with the previous system, and highlight significant changes that may affect your tax-saving tactics. Learn more from this simple guide from EximPe.

A Brief Overview of India's Dual Tax System

Let's quickly review India's dual tax regime system, which is still in place, before getting into the specifics of FY 2025–2026:

Key Highlights of the New Tax Regime for FY 2025-26:

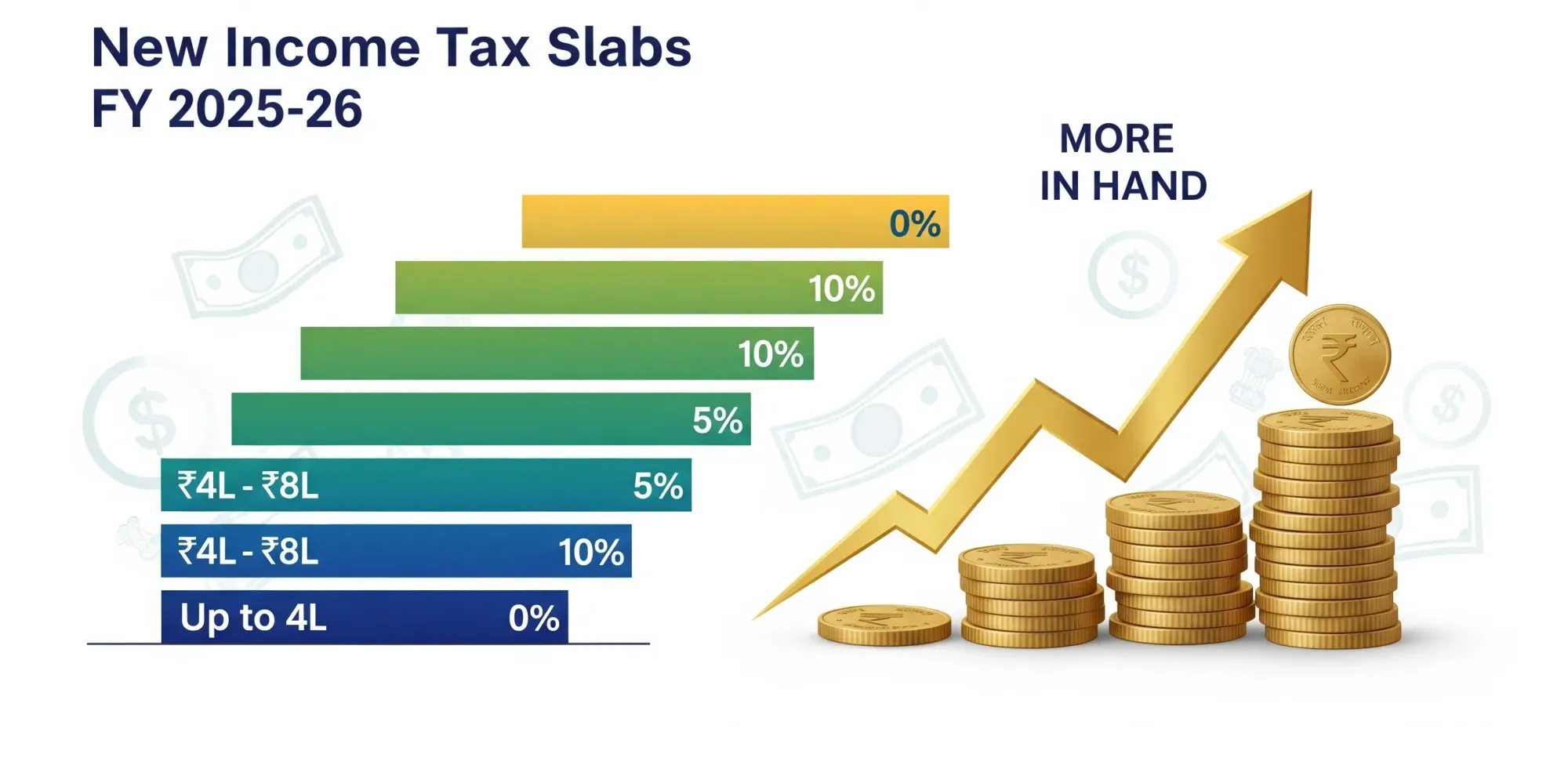

- Enhanced Basic Exemption: The basic limitation of the new regime is raised to 4 lakhs rupees which was 3 lakhs rupees previously. This implies that up to 4 lakh has now become a 100 percent tax-exempted income under this regime.

- Better Rebate within Section 87A: It is a game changing. Section 87A Tax rebate has been hugely hiked. This increase in the rebate means that individuals with taxable income up to 12,00,000 will become exempted of any tax under the new regime. This is a huge increase over the earlier threshold of 7,00,000.

- Standard Deduction to Salaried Person: In the new tax regime, salaried individuals and pensioners have the option to avail a new system where they have a standard deduction by 75000. This slabs down further the tax payable income and once this is added with the rebate under Section 87A, the income of up to 12, 75,000 is practically becoming tax-free income to the salaried taxpayers.

- Streamlined Slabs: The new regime also sports a more granular slab structure which is intended to facilitate a smoother increase of tax rates as incomes increase between the various income brackets and could be more advantageous to a greater number of middle-income earners.

- Default Option, But Choice Remains: The new tax regime will be a default setting, but then the taxpayer will still be given choice to continue working under the old tax regime in case he/she feels it is more beneficial to him/her considering his/her deductions and exemptions. In this you can make a choice during the filling of your Income Tax Return. However, taxpayers with business incomes are also given a one time opportunity of returning to the old regime.

Old Income Tax Slabs for FY 2025-26 (AY 2026-27)

For those who prefer to continue leveraging various tax-saving instruments, the old tax regime remains an option. The slab rates under the Old Tax Regime for FY 2025-26 are as follows:

For Individuals Below 60 Years of Age & HUF:

For Senior Citizens (60 years to less than 80 years):

For Super Senior Citizens (80 years and above):

Note: A 4% Health and Education Cess is applicable on the income tax liability (including surcharge, if any) in both regimes. Surcharge rates remain applicable based on income thresholds for both regimes.

Which Tax Regime is Better for You? Old vs. New

The choice between the old and new tax regimes hinges on your individual financial situation, particularly the extent of deductions and exemptions you are eligible to claim.

Consider the New Tax Regime if:

- You do not have significant investments or expenses eligible for deductions under sections like 80C, 80D, HRA, LTA, etc.

- You prefer a simpler tax filing process with fewer documents to maintain.

- Your taxable income is within the ₹7 lakh to ₹12 lakh range (or up to ₹12.75 lakh for salaried individuals) as the increased rebate and standard deduction in the new regime can make your tax liability zero.

Consider the Old Tax Regime if:

- You make substantial investments in instruments like PPF, ELSS, NPS (Section 80C, 80CCD).

- You pay significant health insurance premiums (Section 80D).

- You pay house rent and are eligible for HRA exemption.

- You have a home loan and claim interest deductions (Section 24b).

- Your total eligible deductions and exemptions under the old regime collectively exceed the benefit you would receive from the lower tax rates in the new regime.

Rule of Thumb: A common way to decide is to calculate your tax liability under both regimes. If your total deductions (including HRA, LTA, and Chapter VI-A deductions like 80C, 80D, etc.) under the old regime are substantial enough to bring your taxable income into a significantly lower slab or reduce your tax more than the new regime's concessional rates, then the old regime might still be more beneficial. Financial planning tools and online calculators can help you compare your tax liability under both scenarios.

Beyond Slabs: Other Important Changes for FY 2025-26

While tax slabs are a major component, the Budget 2025-26 also introduced other pertinent changes that taxpayers should be aware of:

- Increased TDS Thresholds: Several TDS (Tax Deducted at Source) thresholds have been enhanced, providing relief in terms of upfront tax deductions. For instance, the TDS limit on rent has been increased, and limits for interest payments for senior citizens have also been raised.

- Changes to TCS on Remittances: The Tax Collected at Source (TCS) on foreign remittances under the Liberalized Remittance Scheme (LRS) has seen adjustments, including an increased threshold for general remittances and an exemption for education loans from specified financial institutions.

- Streamlined Tax Filing: The government continues its efforts to simplify the tax filing process, and taxpayers with income from business and profession can now choose which regime they want to opt for.

Conclusion

Income tax structure of FY 2025-26 reflects a clear move to the new set of tax structure, which will be providing a simpler and possibly lower tax burden on a vast majority of the taxpayers, particularly the low to mid-income earners and the ones with negligible deductions. Nevertheless, the old regime with the long list of deductions could be a more successful and even more advantageous alternative for the people who actively invest in tax-saving instruments.

The point to be made here is as a wise tax payer; you should evaluate your financial portfolio by studying your finances that constitute your income, investments and expenditure to make an informed choice. To have the most beneficial tax regime in your own case in the future assessment year, you can refer to a tax advisor or online income tax calculators, which are reliable. Those with recent income tax changes, be current, be in status and maximize the many opportunities the new income tax rules will bring.

FAQs – Frequently Asked Questions about Income Tax Slabs for FY 2025-26

1. Can I switch between tax regimes every year?

Yes, salaried employees can switch between the old and new regimes every year when filing ITR.

2. Is the old income tax slab regime still available for AY 2025-26?

Yes, the old income tax regime continues to be available as an option for taxpayers for AY 2025-26 (FY 2024-25) and AY 2026-27 (FY 2025-26). You can choose between the old and new regimes when filing your Income Tax Return.

3. What is the basic exemption limit under the new income tax slab for FY 2025-26?

Under the new tax regime for FY 2025-26, the basic exemption limit has been increased to ₹4,00,000.

4. How much income is tax-free under the new income tax slab for FY 2025-26?

Under the new tax regime, due to the increased basic exemption limit of ₹4,00,000 and the enhanced rebate under Section 87A, income up to ₹12,00,000 is effectively tax-free for all individuals. For salaried individuals, this limit further extends to ₹12,75,000 due to the new standard deduction of ₹75,000.

5. Can I claim standard deduction under the new income tax slab for AY 2025-26?

Yes, salaried individuals and pensioners can now claim a standard deduction of ₹75,000 under the new tax regime for AY 2026-27 (FY 2025-26).

6. What is the difference between income tax slab for AY 2025-26 and FY 2025-26?

FY refers to the Financial Year, which is the period during which income is earned (e.g., April 1, 2025, to March 31, 2026). AY refers to the Assessment Year, which is the year immediately following the Financial Year, during which the income earned in the FY is assessed (e.g., April 1, 2026, to March 31, 2027). So, the income tax slabs for FY 2025-26 are applicable for AY 2026-27.

7. Does the old tax regime offer any benefits for FY 2025-26?

Yes, the old tax regime continues to offer the benefit of claiming various deductions and exemptions under different sections of the Income Tax Act (e.g., 80C, 80D, HRA, LTA). If your eligible deductions are substantial, the old regime might still result in lower tax liability compared to the new regime.

8. What are the key changes in India income tax slab rates 2025 for businesses?

The blog primarily focuses on individual income tax slabs. While the budget did announce some relief for startups and changes related to TDS/TCS for businesses, the core income tax slabs for companies and firms remain largely separate from individual tax slabs, often involving specific corporate tax rates and presumptive taxation schemes.

9. How do I decide which income tax slab regime to choose for FY 2025-26?

To decide, compare your tax liability under both the old and new regimes. Calculate your tax under the old regime by considering all eligible deductions and exemptions. Then, calculate your tax under the new regime using the simplified slabs and the new standard deduction (if applicable). Choose the regime that results in lower tax payable. Online income tax calculators can assist in this comparison.

10. Are there any changes to surcharge rates for FY 2025-26?

Under the new tax regime, the highest surcharge rate has been reduced from 37% to 25%. Other surcharge rates remain applicable based on income thresholds for both regimes, with a 4% Health and Education Cess on top of the calculated tax and surcharge.