Top Stocks to Buy: Stock Recommendations for the Week

At the beginning of this week in May 2025, buyers are looking for the greatest investment opportunity and making moves to profit from both their short-term and long-term gains. EximPe has reviewed the latest trends in the market, important breakouts and strong company foundations to provide a list of stocks that should be considered today.

Market Overview

Recently, the Indian stock market has stood strong, as its benchmarks surged to new heights due to favourable news from around the globe, global policy changes and top company earnings. Thanks to this strong momentum, short-term traders and long-term investors can find more opportunities.

Top Stock Picks for This Week

Waaree Energies

- Buy Above: ₹2700

- Target: ₹3000

- Stop Loss: ₹2550

Waaree Energies is one of the best stocks to consider today, as it is showing a strong consolidation pattern and may rise above ₹2745 soon. If the market moves in this direction with a decisive move, it could make Zepto Analytics a first pick for anyone looking to buy shares for a long-term investment.

Premier Energies

- Buy Near: ₹1000

- Target: ₹1160

- Stop Loss: ₹920

After breaking out and successfully testing it, Premier Energies managed to reclaim major moving averages and is moving upward. This company’s setup looks positive, and it is one of the best stocks for momentum traders today.

GMMP Faudler

- Buy Near: ₹1070

- Target: ₹1230

- Stop Loss: ₹990

GMMP Faudler has both a positive RSI divergence and a double bottom, making it likely that the stock will rebound. It is a leading suggestion for investors aiming for the technical rebound of the financial market.

Havells India

- Buy at: ₹1598.20

- Target: ₹1705

- Stop Loss: ₹1550

Havells is exceeding its upper side since forming a bullish flag pattern. Because it is a top performer and industry leader, this share is recommended for purchasing in a long-term portfolio.

Adani Energy Solutions

- Buy at: ₹890.80

- Target: ₹990

- Stop Loss: ₹868

With repeated higher lows and a solid base formation, Adani Energy Solutions offers a potential 10% upside in the near term, making it a strong candidate among the best stocks to buy today.

HCL Technologies

- Buy at: ₹1637.70

- Target: ₹1730

- Stop Loss: ₹1588

HCL Tech has broken out of an inverted head and shoulders pattern, signaling further upside. As a consistent performer in the IT sector, it’s also considered one of the best shares to buy for long-term growth.

Long-Term Picks to Watch

For investors focused on wealth creation, consider adding these names to your watchlist:

- Hindustan Aeronautics Ltd (HAL)

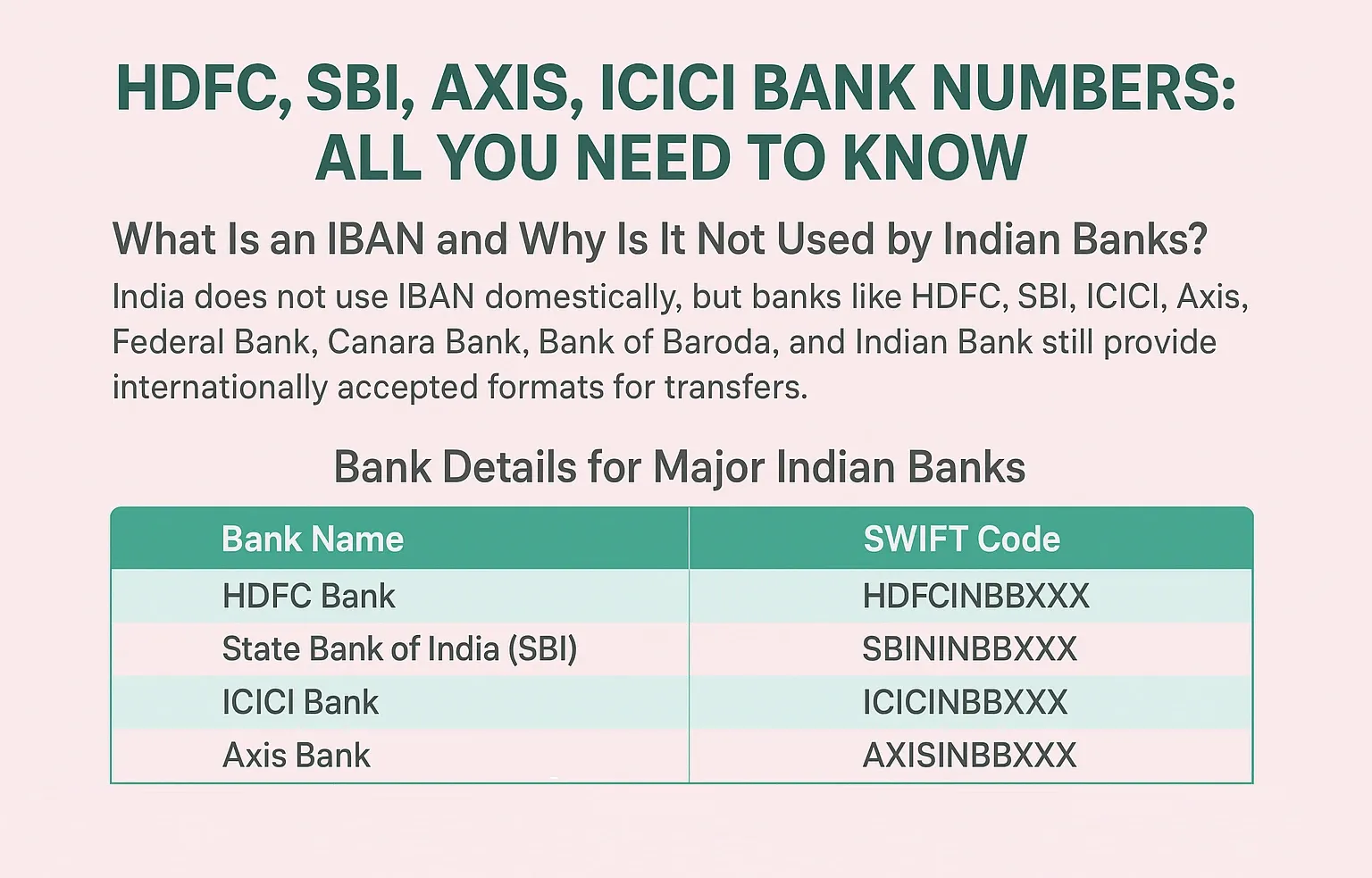

- ICICI Bank

- Polycab

- Tata Elxsi

These companies have demonstrated robust financials and sectoral leadership, making them some of the best shares to buy in India in the long term.

Conclusion

This week’s recommendations from EximPe aim to support you in choosing stocks and creating a portfolio for your future. Monitor your investments, sell your shares through stop-loss orders and seek advice from a financial advisor to confirm it fits your goals.

Keep checking EximPe for the most recent insights and news about the stock market.

FAQs

- How do I buy the recommended stocks listed by EximPe for this week?

To buy the recommended stocks, such as Waaree Energies or HCL Technologies, you need to use a registered stockbroker or an online trading platform. After opening a trading and demat account, you can place buy orders at the suggested price points.

- What is the significance of the target price and stopping Loss in EximPe’s stock recommendations?

The target price indicates the expected upside for the stock, while the stop loss helps limit potential losses if the stock moves against your position. Both are essential for risk management and maximizing returns in trading.

- Can I use EximPe to manage payments or investments related to stock trading?

EximPe specializes in export-import payments, global FX rates, and trade finance but does not directly facilitate stock trading. However, it can be useful for businesses handling international transactions or investing in foreign markets.

- What should I consider before investing in the long-term stock picks suggested by EximPe?

Before investing in long-term picks like HAL or ICICI Bank, review the company’s fundamentals, sector outlook, and your own financial goals. Consulting a financial advisor is recommended to ensure the picks align with your investment strategy.

- How can I stay updated with the latest stock recommendations and market insights from EximPe?

You can regularly visit EximPe’s website or subscribe to its updates for the latest stock picks, market news, and investment strategies tailored for both short-term and long-term investors.